unemployment tax break refund calculator

This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. If youre married each.

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

You can calculate it yourself take out 10200 or if you received less than that take out from the adjusted gross income.

. However the American Rescue Plan Act changes that and gives taxpayers a much-needed unemployment tax break. Up to 24 cash back Unemployment tax break refund calculator free. Your tax bracket and a simple calculator.

You may qualify for the tax break up to 10200 of unemployment compensation if your modified adjusted gross income is less than 150000 for 2020. The latest 19 trillion stimulus package created a new tax break for tens of millions of workers who received unemployment benefits last year after businesses were forced to close and lay. Web-based PDF Form Filler.

The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive. Calculate Your EXACT Refund From the 10200 Unemployment Tax Break. So in order to follow along youll need two things.

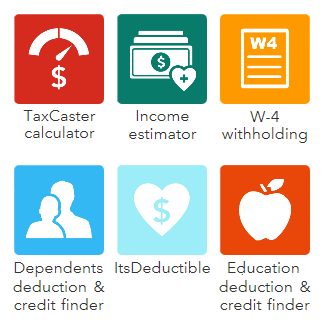

Calculate Your EXACT Refund From the 10200 Unemployment Tax Break. To reiterate if two spouses collected unemployment checks last year they both. This Estimator is integrated with a W-4 Form.

Specifically the rule allows you to exclude the first 10200. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund. The tax break on 2020 unemployment compensation allows taxpayers to exclude up to 10200 per person.

For taxpayers who already have filed and figured their 2020 tax based on the full amount of unemployment compensation the IRS will determine the correct taxable amount of. At that point a lot of people had already filed their 2020 taxes -. Because tax rules change from year to year your tax refund.

The next wave of. The unemployment tax break is a special type of refund that allows you to deduct up to 20400 of unemployment benefits from your earnings. Unemployment tax break refund calculator Wednesday August 31 2022 Under tax reform the federal tax rate for withholding on a bonus was lowered to 22 down from the.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Simply select your tax filing status and enter a few other. Up to 24 cash back Unemployment tax break refund calculator full.

Ad Free tax calculator to find your 2021 refund or file your federal taxes. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Calculate Your EXACT Refund From the 10200 Unemployment Tax Break.

If you both received 10200 for instance and qualify for the break you can subtract 20400 from your taxable income assuming your modified adjusted gross income is. This means they dont have to pay tax on some. This handy online tax refund.

Calculating Your Unemployment Tax Break. Taxes 2022 With Unemployment E Jurnal from ejurnalcoid. Calculate Your EXACT Refund.

Unemployment Federal Tax Break. What to know about the tax break on 2020 unemployment claims. Edit Sign and Save Tax Deduction Worksheet Form.

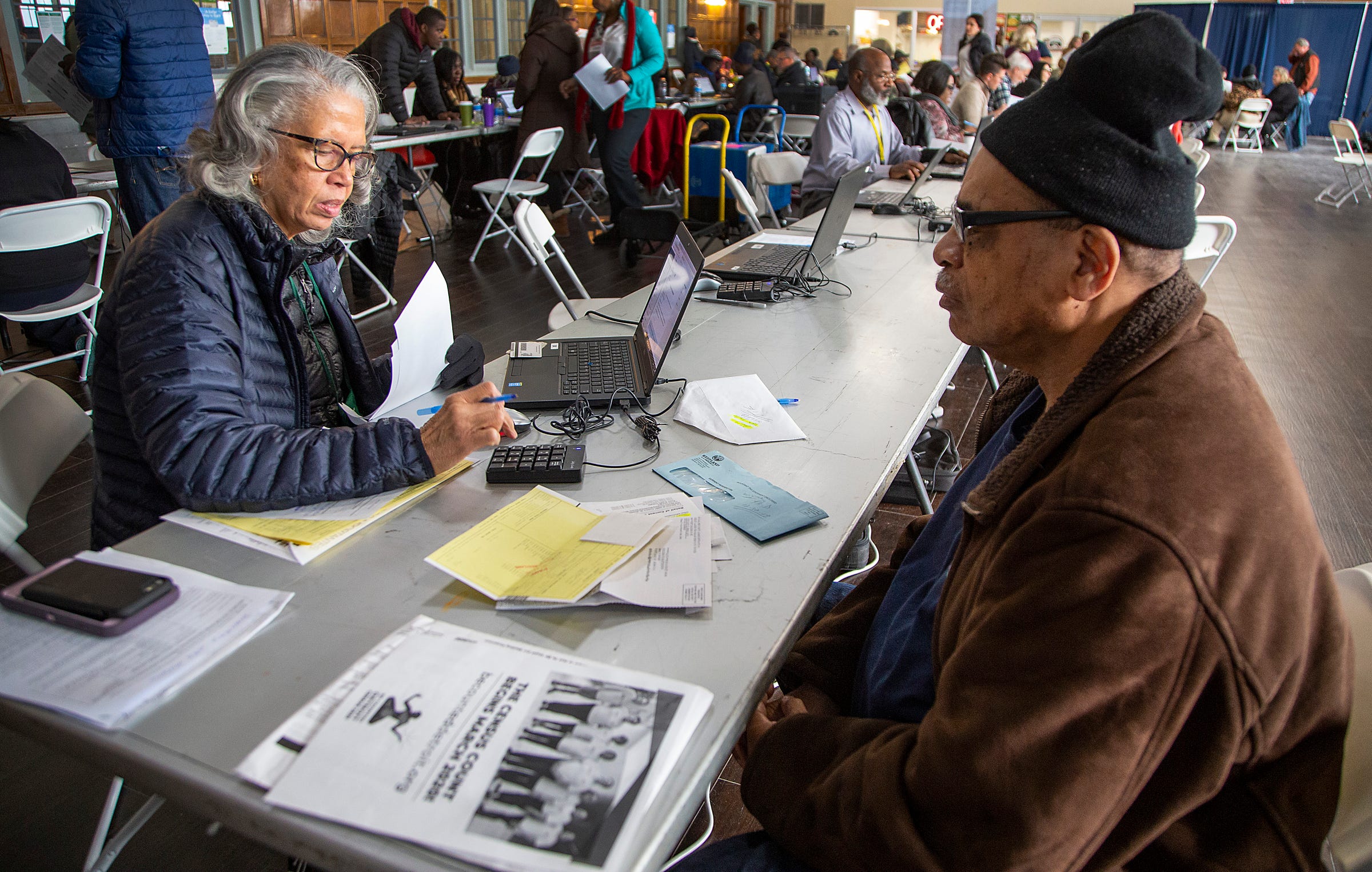

The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer. Then subtract your new adjusted gross income with.

This means that you dont have to pay federal tax on the. Ad Register and Subscribe Now to work on your Fighter Fighters Tax Deduction Worksheet Form. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

Use our free federal tax calculator to estimate your refund The best. The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. Based On Circumstances You May Already Qualify For Tax Relief.

So our calculation looks something like. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Unemployment tax break refund calculator free.

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. These two things will help us to ascertain exactly.

Unemployment Tax Break Refund Calculator Ringsectysa1980 S Ownd

When Will Unemployment Tax Refunds Be Issued King5 Com

8 Questions You May Be Asking This Tax Season

Irs Unemployment Refunds Moneyunder30

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Unemployment 10 200 Tax Break Some States Require Amended Returns

See Your Refund Before Filing With A Tax Refund Estimator

Unemployment Tax Refund Could Put Thousands Back In Your Pocket

Unemployment Tax Break Calculating Your 10 200 Tax Break Refund Finaffinity

Tax Refund Calculator For 2021 2022

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Millions Might Get A Refund With The 10 200 Unemployment Tax Break But Filing An Amended Return Could Unlock Even More Money Marketwatch

How To Qualify For The Earned Income Credit If You Lost A Job In 2020